A Guide to Mutual Fund Investing: How to Build a Personalized Financial Portfolio

Image Source: unsplash

When building a wealth portfolio, you must first clarify your objectives. You may prioritize stable returns or seek higher growth. Your risk tolerance influences fund selection. For instance, fixed-income funds suit those with low risk tolerance, equity funds attract those chasing high returns, and balanced funds appeal to those seeking a mix of growth and stability. Your investment horizon also matters. Diversification reduces risk, and continuous learning enhances asset management. This mutual fund investment guide helps you craft a suitable strategy.

Key Highlights

- Define clear investment goals to guide fund selection. Specific, measurable objectives align your choices with your financial aspirations.

- Assess your risk tolerance to choose funds that match your comfort with volatility, ensuring sustainable wealth growth.

- Diversify investments across asset types and funds to mitigate risks from single-market fluctuations.

- Review your portfolio annually to ensure alignment with risk tolerance and goals, adjusting strategies as needed.

- Focus on fund fee structures. Opt for low expense ratios to avoid high costs eroding long-term returns.

Mutual Fund Investment Guide

Basic Concepts

To start with this guide, understand what a mutual fund is. A mutual fund is an investment company that pools money from multiple investors by selling shares, managed by an asset management company investing in stocks, bonds, money market instruments, and other assets. By purchasing shares, you become a partial owner, sharing in the fund’s income and capital gains proportional to your holdings.

The operational structure involves several roles:

- Asset management companies handle daily management and investment decisions.

- Trustees oversee operations to protect investor interests.

- Custodians safeguard fund assets.

- Transfer agents maintain investor records.

- Auditors ensure financial transparency.

- Brokers facilitate securities transactions.

This structure provides a secure, professional environment for investors.

Mutual funds suit various investors. If you prefer long-term holding and market tracking, passive investing works. If you analyze markets for above-average returns, active investing may suit you.

Main Types

When selecting mutual funds, you’ll encounter various types: equity, bond, balanced, money market, and index funds, each with distinct investment focuses and risk-return profiles.

| Fund Type | Risk Level | Return Characteristics |

|---|---|---|

| Equity Funds | High | Potentially high returns |

| Bond Funds | Low | Stable returns |

| Balanced Funds | Moderate | Balances risk and return |

| Money Market Funds | Low | Low returns, capital preservation |

| Index Funds | Variable | Returns track market indices |

Choose funds based on your risk tolerance and financial goals.

Risk and Return

This guide highlights that fund types vary significantly in risk and return. Equity funds are volatile, ideal for high-return seekers. Bond funds offer lower risk, suitable for conservative investors. Balanced funds strike a middle ground. Money market funds prioritize safety for capital preservation. Index funds’ risk and return depend on the tracked index.

The guide advises clarifying your risk tolerance and goals before investing. Proper fund selection drives wealth growth.

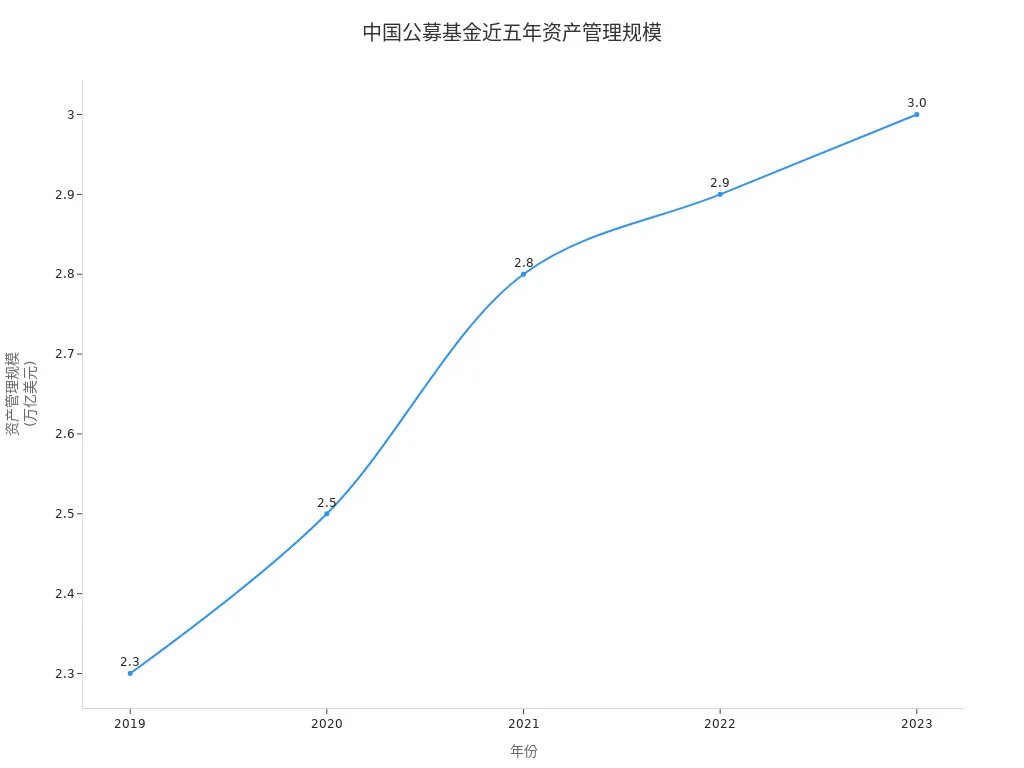

In mainland China, the mutual fund industry grew steadily from 2019 to 2023, reflecting growing investor trust in mutual funds.

Goals and Risk

Setting Goals

Start by defining clear financial goals to guide fund selection and strategy. Follow these steps:

- Identify your “why”: Determine your motivation, such as saving for education, retirement, or wealth growth.

- Conduct a financial review: Assess assets and liabilities to understand your financial position.

- Set SMART goals: Ensure goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

- Revisit your “why”: Align goals with core values.

- Create an action plan: Outline specific steps for each goal.

Use tools like Empower’s financial calculators to plan budgets, long-term savings, or retirement goals, keeping investments aligned with objectives.

Risk Assessment

Assess your risk tolerance to select suitable funds. Methods include:

- Completing investor profile questionnaires to gauge risk preference.

- Evaluating financial capacity to withstand losses.

- Considering investment horizon and goals to determine risk capacity.

- Using risk assessment surveys to position yourself between conservative and aggressive.

- Answering key questions to clarify risk tolerance.

These methods help identify a portfolio that suits you.

Investment Horizon

Your investment horizon influences fund choice and expected returns. The table below shows how horizons affect fund selection:

| Fund Type | Horizon Change | Spending Flexibility Change |

|---|---|---|

| Income Funds | Increases | Decreases |

| Growth Funds | Increases | Increases |

Longer horizons allow riskier portfolios, while shorter ones favor conservative strategies. Align your horizon with goals and liquidity needs.

The guide emphasizes that setting goals, assessing risk, and defining your horizon are foundational to building a portfolio. Clarity on these ensures a scientific investment plan.

Asset Allocation

Image Source: unsplash

Diversification

Diversification is key to reducing risk in your portfolio. Allocate funds across asset types and funds to avoid single-market volatility impacting your entire portfolio. Include equities, bonds, and money market funds to enhance stability.

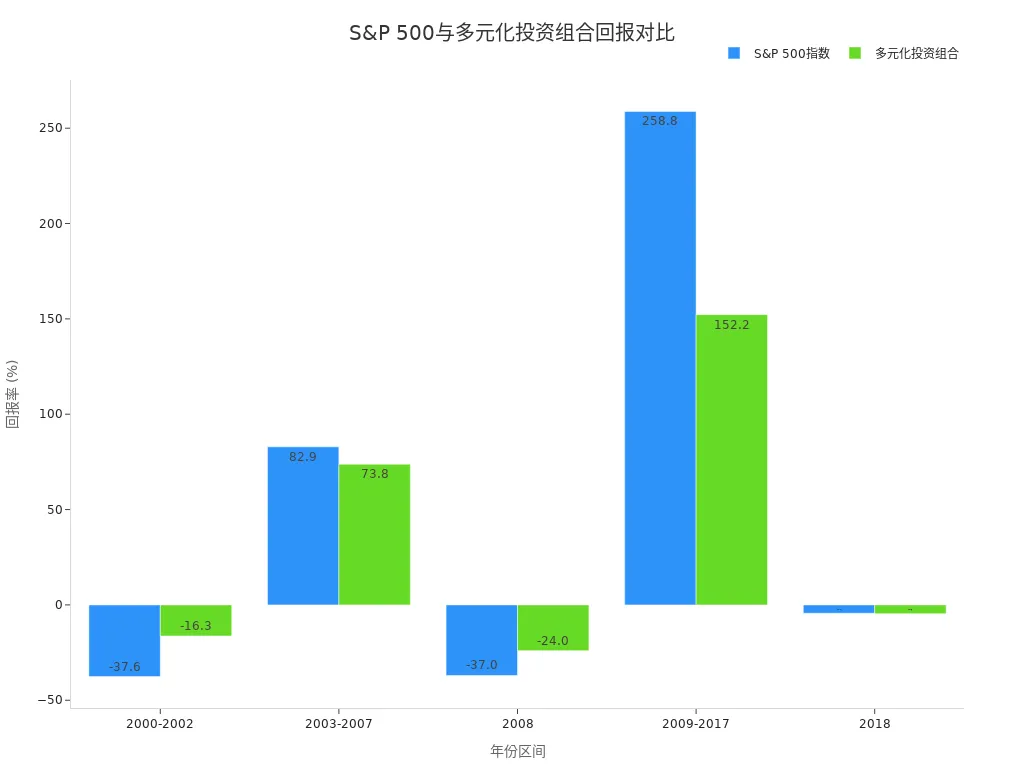

Research shows diversified portfolios outperform the S&P 500 in the U.S., delivering significant diversification benefits. International diversification performed well pre-2009, but benefits declined as market correlations increased. The table below illustrates risk reduction:

| Portfolio Type | Performance | Risk Reduction Effect |

|---|---|---|

| Cross-Asset Diversified | Outperforms S&P 500 | Significant diversification benefits |

| International Diversified | Strong pre-2009 | Reduced benefits post-2009 due to higher correlations |

Diversifying across fund families improves downside protection. Larger fund families with varied objectives offer higher diversification.

Investing in low-correlation assets enhances diversification and reduces volatility. A correlation of 1.00 indicates full correlation, increasing risk, while below 1.00 lowers risk.

| Correlation | Impact |

|---|---|

| 1.00 | Fully correlated, higher risk |

| < 1.00 | Lower correlation, reduced risk |

Diversification builds a robust portfolio. Prioritize low-correlation assets for stability.

Number of Funds

Balance risk diversification and management costs when choosing fund numbers. Too many funds complicate management; too few limit diversification. Research suggests holding 5 funds significantly reduces volatility. The table below shows volatility impacts:

| Number of Funds | Volatility (Growth & Income Funds) | Volatility (Growth Funds) |

|---|---|---|

| 1 | 18% | 23% |

| 5 | 11% | 10% |

| 1 | 37% | 59% |

| 5 | 19% | 22% |

Holding 3-7 diverse funds balances risk and manageability. Avoid funds with similar performance to prevent increased risk during downturns.

- Similar asset classes increase risk.

- Low-correlation assets enhance diversification, reducing volatility.

Control fund numbers to optimize risk management.

Core-Satellite Strategy

Adopt a core-satellite strategy to balance stability and growth. The core includes stable, low-cost assets like investment-grade bonds and large-cap equities. Satellites include high-risk, high-return assets like small-cap stocks, emerging markets, or sector funds.

- Core investments ensure stability and low costs.

- Satellites boost return potential with higher risk.

- This strategy manages risk and enhances returns through diversification.

Allocate 60-80% to the core and 20-40% to satellites based on goals and risk tolerance. This approach manages risk and adapts to market changes, fostering steady growth.

- Effectively manages risk.

- Enables retail investors to adapt to market shifts.

- Promotes consistent growth.

In the U.S., use index funds as the core and growth or sector funds as satellites. Purchase funds via licensed Hong Kong bank platforms, with transactions in USD for global allocation.

Combine diversification, moderate fund numbers, and core-satellite principles to build a tailored portfolio. Adjust dynamically based on needs and markets for long-term growth.

Fund Selection

Image Source: unsplash

Screening Criteria

Select funds based on your needs and market data. Professional investors use these criteria:

- Review Morningstar ratings or long-term performance to identify stable funds.

- Check expense ratios, prioritizing low-fee funds.

- Assess performance volatility, avoiding erratic funds.

- Study investment strategies and risk controls.

- Evaluate fund managers’ experience and track records.

- Monitor portfolio turnover rates to minimize hidden costs.

- Avoid small-scale funds for better efficiency and liquidity.

Historical performance and consistency matter. Studies show investors favor strong past performers. Analyze long-term returns and stability to gauge manager skill. The table below summarizes findings:

| Evidence Type | Content |

|---|---|

| Research Findings | Strong correlation between investor preferences and past performance. |

| Performance Persistence | Helps assess manager ability for informed choices. |

| Market Behavior | Investors favor funds with strong historical performance. |

Combine these criteria to select funds matching your needs.

Fee Structure

Fees significantly impact returns. Common fees include:

- Front-end Load: Paid when purchasing shares, some funds waive this.

- Management Fee: Annual charge based on assets, typically a percentage.

- 12b-1 Fee: For marketing and distribution, if applicable.

- Redemption Fee: Charged for early withdrawals.

- Other Operating Fees: Custody, audit, etc.

Fees significantly affect long-term returns. High fees erode gains, often overlooked. Prioritize funds with expense ratios below 0.25% to avoid high commissions. Investors focusing on fees select cost-efficient portfolios, boosting returns.

Compare fee structures to choose cost-effective funds. In the U.S., index and passive funds often have lower fees than active funds, enhancing long-term savings.

Management Style

Consider management style when selecting funds: active or passive.

- Active Management: Managers select securities to outperform benchmarks. Assess their experience, performance, and strategy alignment. Due diligence ensures investor-manager alignment.

- Passive Management: Tracks indices for market-like returns with lower fees, ideal for steady growth.

The table below shows U.S. active fund performance:

| Type | Active Management Performance |

|---|---|

| Equity-Heavy Funds | 13.4% |

| Large-Cap Growth Funds | 9.7% |

| Small/Mid-Cap Funds | 38.2% |

| Consumer Goods Funds | 69.9% |

| Healthcare Funds | 58.9% |

| Tech/Telecom Funds | 19.8% |

Performance varies by sector. Balance active and passive funds based on risk and goals. Use licensed Hong Kong bank platforms for fund purchases in USD.

Consider screening criteria, fees, and management style to build an optimal portfolio for sustained growth.

Portfolio Management

Regular Reviews

Regularly review your portfolio to align with risk tolerance and goals. Annual checks ensure proper asset distribution. Maintain diversification, monitor fees and performance, and track market trends. Collaborate with licensed Hong Kong bank advisors for professional reviews, with transactions in USD.

Annual rebalancing controls risk, outperforming unadjusted portfolios.

- Check asset allocation alignment.

- Ensure diversification to spread risk.

- Monitor fees and performance for cost-efficiency.

- Track market trends for informed decisions.

- Seek professional advice if needed.

Dynamic Adjustments

Dynamic adjustments are vital as markets, economic cycles, and goals shift. Rebalance annually or when allocations deviate significantly. Triggers include market shifts, dividend reinvestments, or life events. Dynamic strategies outperform static ones, reducing losses and boosting retirement assets.

- Rebalance annually to avoid excessive adjustments.

- Adjust when allocations exceed set ranges.

- Adapt to goal changes, market shifts, or life events.

- Regularly evaluate plans and contributions.

Continuous learning enhances adaptability. Study U.S. market cases to optimize allocations for steady growth.

Follow these steps to build your portfolio:

- Define clear goals and long-term plans.

- Assess risk tolerance for asset allocation.

- Select cost-effective mutual funds.

- Regularly review and adjust the portfolio.

Longer investment horizons increase positive return likelihood. Optimize portfolios, invest rationally, and hold long-term for growth. Continuous learning and experience prevent emotional decisions and overcomplication.

FAQ

What are the main risks of mutual fund investing?

You face market, interest rate, and liquidity risks. Market fluctuations impact net asset values. Choose funds matching your risk tolerance.

Diversification mitigates overall risk.

How to evaluate a fund manager’s ability?

Review historical performance and experience. Assess investment strategies and team stability. Consistent long-term performers are more reliable.

What fees should I watch for when buying mutual funds?

Monitor front-end loads, management fees, and redemption fees. Some funds charge 12b-1 fees. Prioritize low expense ratios for higher returns.

| Fee Type | Description |

|---|---|

| Front-end Load | Paid at purchase |

| Management Fee | Annual charge |

| Redemption Fee | Charged for early exits |

Can I redeem mutual fund shares anytime?

You can redeem open-end fund shares during trading hours. Some funds have redemption fees or minimum holding periods. Check rules for liquidity planning.

How to adjust a portfolio periodically?

Review annually, adjusting based on market changes and goals. Collaborate with Hong Kong bank advisors for professional guidance, with transactions in USD.

With the mutual fund investment guide, you’re equipped to craft a tailored portfolio, but high cross-border fees, currency volatility, and complex offshore account setups can limit your ability to allocate to U.S. or global funds, especially when swift adjustments are needed. Envision a platform with 0.5% remittance fees, same-day global transfers, and contract limit orders with zero fees, enabling seamless portfolio optimization via one account?

BiyaPay is designed for mutual fund investors, offering instant fiat-to-digital conversions to respond nimbly to market shifts. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers quick allocations to S&P 500 index funds (like VOO) or global bond funds. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging contract limit orders with zero fees for risk-assessment-based limit strategies.

Whether seeking steady income or long-term growth, BiyaPay empowers your journey. Sign up now, visit stocks for U.S. fund prospects—quick setup unlocks cost-effective, data-driven investing. Join global investors and achieve robust wealth growth in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

How to Choose US Major Indices: Pros and Cons Analysis of S&P 500, Dow Jones, and Nasdaq

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.