How to open an account with HSBC Bank in the United Kingdom?

HSBC, one of the largest banks in the world, is present in more than 60 countries and regions, serving more than 50 million customers. In the United Kingdom alone, HSBC has more than 300 branches, mainly located in England and Wales. This article will focus on three popular deposit accounts of HSBC in the United Kingdom, explaining in detail the account opening conditions, account opening process, and possible fees involved in HSBC UK.

HSBC Account Types

United Kingdom HSBC offers various options such as current account, current/fixed deposit account, ISA account, and comprehensive foreign currency account. The general practice is to open a current account first, and after becoming an HSBC customer, you can apply for additional savings or foreign currency accounts according to personal needs through the bank’s APP.

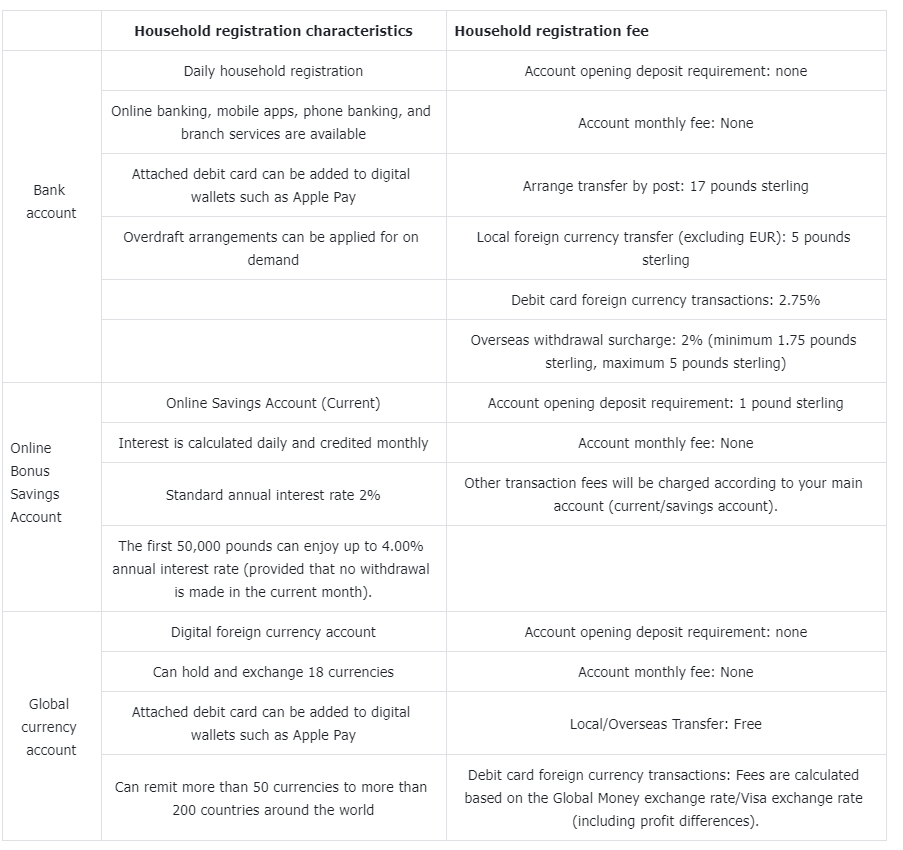

The following is a comparison of the functions and fees of three popular household registration types.

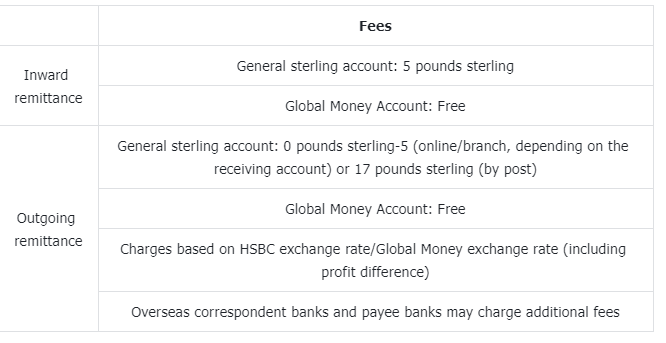

In addition, if you want to transfer money to a foreign country through HSBC, the telegraphic transfer fee is as follows:

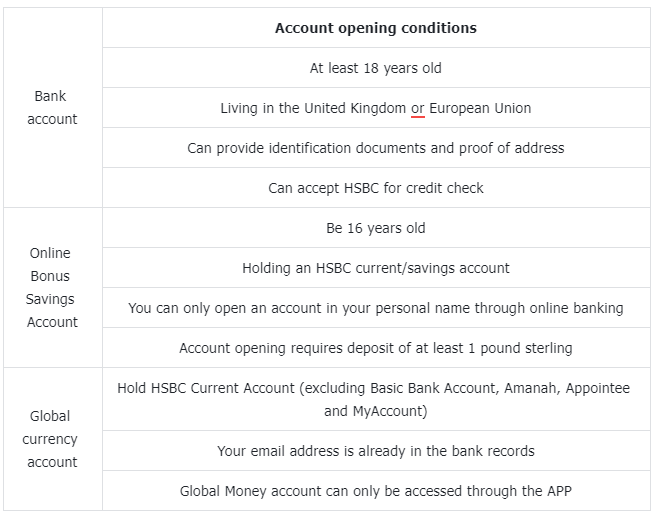

HSBC United Kingdom Account Opening Conditions

What documents are required to open an account with HSBC Bank in the United Kingdom?

To open an account with HSBC Bank in the United Kingdom, you need to prepare the following documents and materials:

- Proof of identity: can be a valid identity document such as a passport, European Union ID card or United Kingdom driver’s license.

- Proof of Address: A statement or utility bill issued by a United Kingdom bank within the last four months is required to prove the address.

- Address records for the past three years: Provide address information for the past three years to help banks with identity verification and credit checks.

- Employment and income details: Provide proof of employment and income information to demonstrate financial status.

If the above address proof cannot be provided, HSBC also accepts the following alternative documents:

- Lease or mortgage documents: can be used as proof of address.

- Confirmation letter from employer: Proof of your address and employment status.

- Letters from educational institutions: Applicable to applications for opening student accounts.

How much does it cost to open an HSBC account in the United Kingdom?

The three HSBC accounts mentioned above do not have any account opening capital requirements, or are as low as 1 pound sterling.

HSBC United Kingdom Account Opening Process

Here are the steps to open an account with HSBC Bank in the United Kingdom:

- Log in to the HSBC UK website to view different account types and account opening conditions

- Select “Apply for Personal Account” or “Apply for Joint Account”.

- Confirm that you meet the account opening requirements and prepare the required documents/materials

- Fill out the online form, which consists of 5 pages (personal information, contact information, employment and tax information, account opening purpose).

- Submit the form and wait for the bank to contact you

How to remit money to HSBC

If you have needs for overseas travel, overseas investment, etc., after opening an HSBC bank account, you can meet these needs by binding BiyaPay. It is an international wallet that provides multi-asset transactions for users worldwide. Its functions include global payment and international remittance, as well as major investment services such as US/Hong Kong stocks, options, and digital currencies.

Its most notable feature is that it supports real-time exchange rate inquiry and exchange of more than 20 legal currencies and more than 200 digital currencies, allowing for large remittances in most countries or regions around the world anytime, anywhere, with fast arrival speed, low handling fees, and unlimited limit.

If you often need to frequently exchange and transfer in different currencies, you will encounter various deposit and withdrawal troubles, such as: settlement and purchase foreign exchange limit, telegraphic transfer limit, no Hong Kong card or offshore account, cross-border remittance difficult, difficult to return to China, slow deposit and withdrawal of securities companies, miss the market or seriously lead to liquidation and other difficulties, then for the above difficulties, you can also use BiyaPay as a professional deposit and withdrawal tool .

The above is the relevant introduction to opening an account with HSBC. After familiarizing yourself with the process, you can operate it by yourself. I wish you all a pleasant user experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.